If you are looking to buy a new home or refinance your current home, please contact us first here! Our team has access to the best mortgage options available.

Take Note:

~ Renting costs between $20,000 - $42,000/year +/- ..... this is paying someone else's mortgage... pay into your future if you can - or set a plan where you will be able to do so in the future - the choice is yours.

~ This includes A, B & second mortgages

~ There is no cost, obligation or pressure

~ Asking the question will not affect your credit rating. Our mortgage professionals are professionals, they ask questions first and let you know what they belive the outcome will be before moving forward.

~ Our team has options for refinancing so you can keep you home and not have to sell.

~ 100% confidentiality 100% of the time you work with us.

~ Care - we care about you and your family ??

~ Owning your own home is NOT out of reach - get in touch to find out more ??

Call/text 226-400-6458 and have an over the phone quick evaluation of your needs.

The Bank of Canada has reduced its overnight rate to 4. 5%. Global growth is projected at 3% annually through 2026. Inflation is expected to gradually decrease, though still above targets. The U. S. is experiencing an economic slowdown, while the euro area is recovering. China's economy is growing modestly. Global financial conditions have eased, with lower bond yields, strong equity prices, and robust corporate debt. The Canadian dollar and oil prices are stable. In Canada, economic growth likely increased to 1. 5% in the first half of the year. However, potential output is outpacing GDP due to population growth, resulting in excess supply. Household spending has been weak, and the labor market shows signs of slack, with the unemployment rate rising to 6. 4%. While wage growth remains elevated, there are signs of moderation.

But what does it all mean??

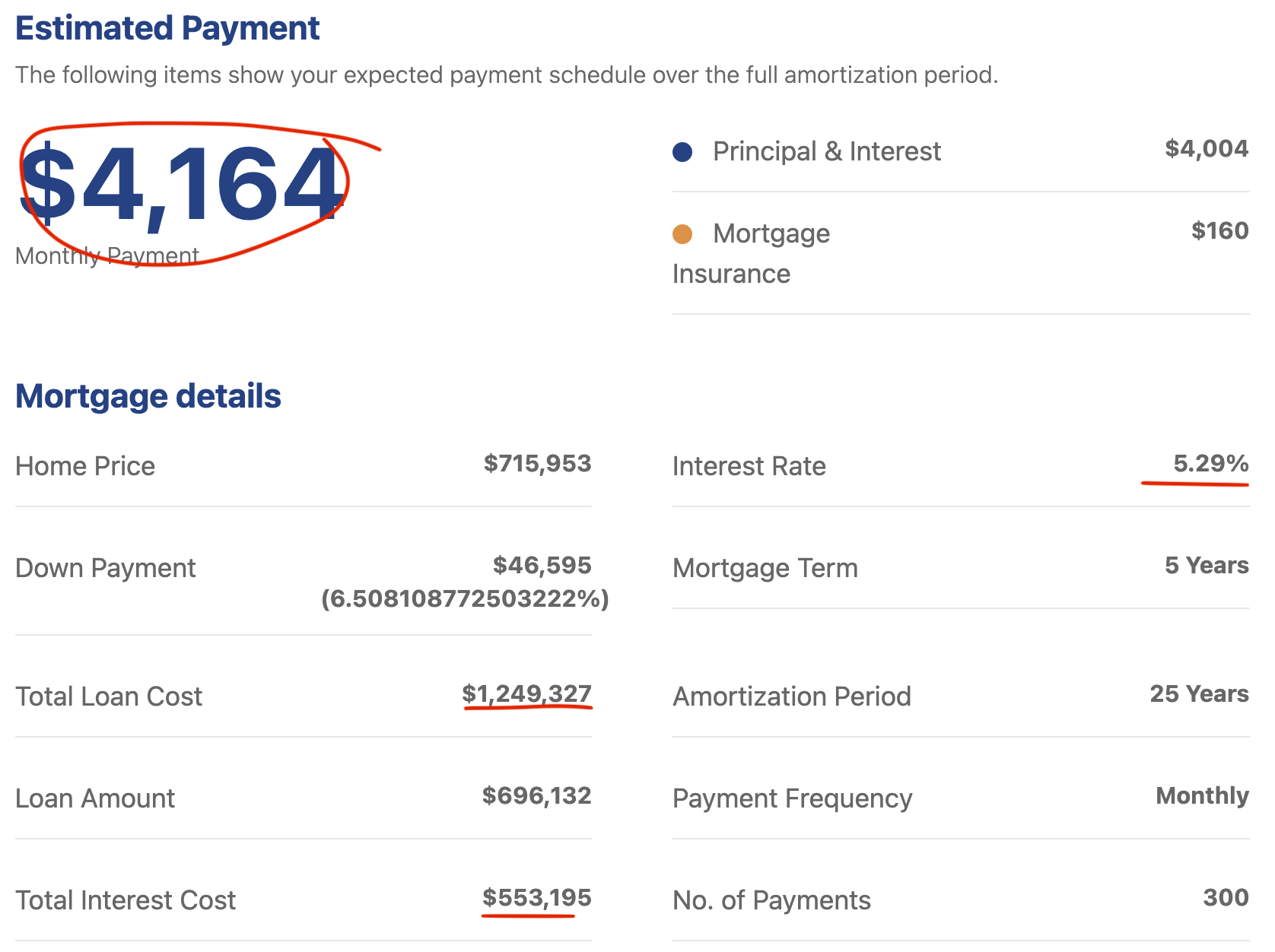

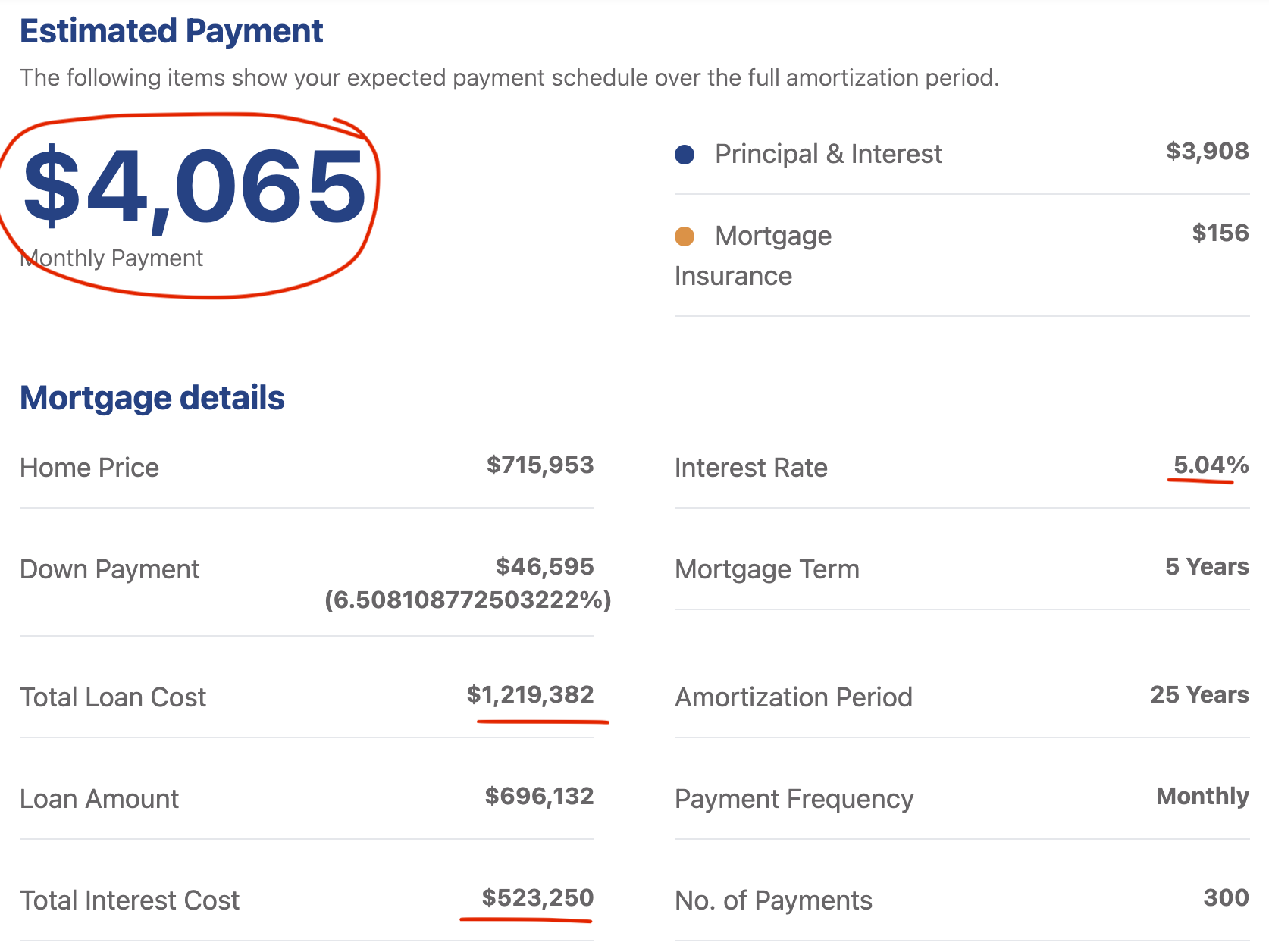

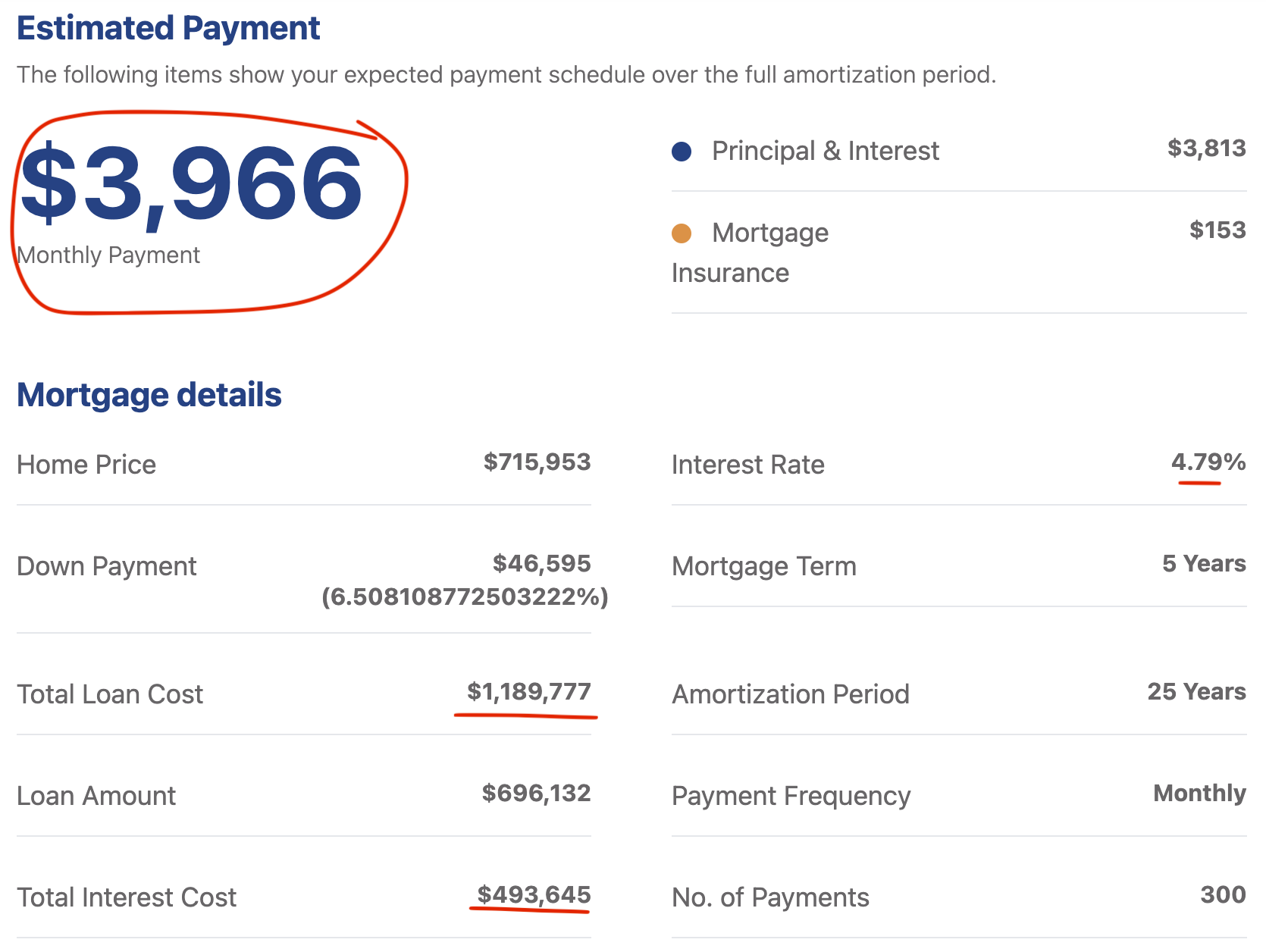

Bank of Canada Rate @ 5% vs 4.5% = a potential savings of $59,550 over 25 years*

- The monthly payments translate in to affordablility based on a buyers unique situation.

- A Seller can potentially sell their home for more, allowing more buying power on thier buy side.

Remember there is what you can afford and what you want to afford - it's no fun to be house poor ??

Call/text 226-400-6458 to find out how we can help you into your next awesome home! As always no cost, obligation or pressure.

Bank of Canada Rate @ 4.75%

Bank of Canada Rate @ 4.5%

* This is running average numbers based on an individual who has A credit. There are MANY scenarios where the numbers will differ - Call us today to find out what your numbers would look like to Buy or Refinance a home. 100% confidential

Read the full article on the Bank of Canada website here